AN OVERVIEW:

The State of Auto F&I Today and What’s

Next for Dealers

Finance and Insurance (F&I) is an integral part of the car buying and selling process. Traditionally, it’s also the part that slows the process down, creating friction and sparking frustration from today’s consumers who expect speed, convenience, and transparency in all retail transactions great and small.

In this article, we’ll survey the landscape of auto F&I today while identifying opportunities for dealerships to alleviate friction and frustration, ultimately resulting in greater customer satisfaction, increased sales, and sustainable profitability. Let’s dig in!

What Does F&I Look Like Today?

The F&I department is where deals are struck for aftermarket products and plans, and can result in a healthy revenue stream for dealerships. While the sales team lands the initial sale, F&I managers are responsible for:

- Creating contractual agreements with customers

- Liaising with lenders

- Negotiating loan terms

- Checking insurance coverage

- Submitting verification paperwork

While these functions are essential to dealerships, the execution of these functions is where friction and frustration can arise during the car buying and selling process.

Presentation of F&I Products:

Extended Warranties or Vehicle Service Contracts

These policies protect the customer's vehicle under certain conditions for a set amount of time and mileage. The components and conditions covered in the warranty are up to the dealership. However, the most common options include:

- GAP Insurance: GAP insurance protects customers should their vehicles become totaled in an accident by paying off the car loan if traditional insurance doesn’t cover the whole amount.

-

Maintenance Plans: Responsible car owners know that regular maintenance can help prevent expensive repairs and extend the lives of their vehicles. Maintenance plans are popular ways for dealers to earn extra income while providing useful services to customers.

Similar to prepaying for gas for a rental car, this F&I product allows customers to pre-buy routine maintenance services like oil changes and tire rotations at a discounted rate. Also similar to prepaying for gas for a rental car, customers often bawk when presented with the option. Why?

Well, did your eyes glaze over while reading through the F&I product descriptions?! Point made. There has to be a better way.

The good news is that, with Fuse, there is. And we’re not just talking sales pointers here. You can get those from experts like Dan Mason, executive vice president at Principal Warranty Corp, who encourages the following approach:

- Calculate how much a consumer would pay for all the routine maintenance work needed over five years of vehicle ownership (i.e., a 60-month maintenance contract duration)

- Divide that amount by 60 months

- Present the average that the owner would spend per month on maintenance during the first five years of vehicle life

- Make the case that the customer would need to pay for maintenance no matter what, asking "Wouldn't you agree?"

It’s likely that your dealership already has multiple strategies for presenting the F&I menu to customers to varying levels of success. But, with Fuse, the F&I presentation is seamless, requiring little-to-no hard sales tactics because customers are delighted by the speed, convenience, and transparency of the process. To better illustrate this delight, let’s compare the current auto F&I process to the Fuse process.

The Current Auto F&I Process

Traditionally, F&I is the last step in the car selling process. A customer has expressed interest in buying a car and heads to the F&I office to seal the deal. If a buyer needs financing, the F&I manager presents options based on the customer’s credit profile, money down, taxes, etc.

Once those details are out of the way, the F&I manager presents the F&I menu and goes over aftermarket options. These include warranties, maintenance plans, and other F&I products a dealership offers (everything listed above and anything else dealers want to add). After the customer chooses what they want or don’t want, the F&I manager presents the final price or monthly payment.

The Fuse Process

Customers expect a great experience. The Fuse process is all about creating that great customer experience — one that allows dealers to compete on more than just price. And in today’s technology-fueled world, customer experience starts well before the presentation of the F&I menu.

Step 1. Reduce Friction and Build Customer Trust with One-Price Selling

An increasing number of dealerships have adopted a one-price sales model to level the playing field among buyers while appealing to consumers’ desire for a hassle-free experience. The one-price sales model benefits buyers, dealers, and salespeople. It's attractive to car buyers because they know what they're getting from the start and can bypass the haggling process.

A one-price sales model provides income stability for employees and removes the pressure of obtaining the highest price on a vehicle. This makes a career in auto sales more attractive to a wider range of talent. It also benefits dealers because sales teams can sell more cars in less time by cutting out the traditional back and forth over price.

Related Read: Dealership Pricing Strategy: Understanding the One-Price Model

Step 2. Enhance the Customer Experience with a Single Point of Contact

Many one-price dealerships have also transitioned to a single-point-of-contact (SPOC) sales model. This SPOC strategy, in hand with the one-price selling approach, creates a seamless customer experience.

One of the key advantages of SPOC is efficiency. In the SPOC sales process, one salesperson manages the entire transaction with the customer, from vehicle selection to test drive, financing, closing, and delivery. Dealers like the SPOC model because it creates a virtuous circle. It's faster, costs less, and customers and employees are happier.

Related Read: Single Point of Contact: 5 Benefits of SPOC for Dealerships

Step 3. Give Customers Greater Transparency into the Dealership F&I Process

One of the most intimidating aspects of buying a car is waiting for a quote in the F&I office. It can feel like a lot is going on behind the computer screen that the buyer can't see. They may wonder: What algorithms determine my quote? Why does it feel secret? Why can’t I participate in negotiating my lending terms?

When dealers make this process more transparent and collaborative, they build trust with shoppers. Most dealers use a desking application that helps calculate quotes based on customers’ criteria and lender requirements. However, not all desking apps are created equal. Any inaccuracies can cause desking bottlenecks when finance managers have to correct information and redo the quote. The last thing dealers want is a line of customers eager to buy a vehicle but having to wait for their turn with F&I.

A good desking tool allows F&I managers to provide quotes from multiple lenders, with the ability to show the customer how the numbers were calculated. A desking solution should also enable finance managers to factor in taxes and other fees for out-of-state customers. When functional gaps happen, it can lead to mistrust and lost sales.

Related Read: 5 Steps to Desk a Car Deal in Under an Hour

Step 4. Maximize Dealership Speed and Efficiency to Realize Sustainable Profitability

One of the most effective strategies for creating sustainable profits in the near and long term is increasing dealership process efficiencies. A digital retail solution can help streamline operations for faster, more profitable transactions while improving the customer experience. Retail technology is a web-based solution that connects to a dealership’s inventory system to sync pricing and incentives while providing instant access to thousands of lending options.

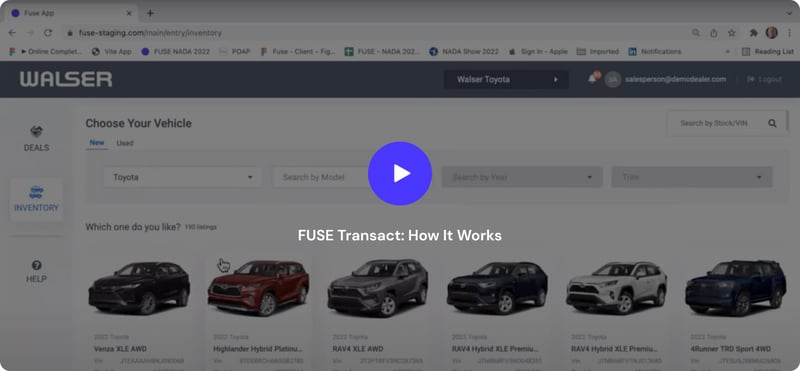

Automating and accelerating the car buying process makes it easier for consumers to get the car they want with less hassle. Fuse's automotive digital retailing solution integrates directly into a dealer’s website vehicle details page (VDP), providing buyers everything they need to make a purchasing decision right at the moment of interest so that dealers can sell more cars in less time.

Related Read: Solved: How to Build Sustainable Dealer Profitability

Step 5. Sharpen Your Competitive Edge with Training and Development

A dealership’s success depends on its people. That’s why it’s important to provide them with the tools and resources necessary to succeed. Ultimately, having and retaining highly-trained, capable staff drives dealer profitability. Fuse Autotech works directly with dealers to create a custom plan and provide comprehensive training and coaching sessions with staff to help set dealership teams up for success.

Related Read: Dealership Business Model: The Future of Automotive Retail

What’s Next for Car Dealership F&I?

The car buying and selling process is currently undergoing a major overhaul. To contend with the pandemic, more dealers are moving to a digital-first model that allows car shoppers to start the buying process online. Automating some of the typical F&I sales steps before the customer arrives at the dealership means the role of a dedicated F&I manager is evolving.

Related Read: Auto Retailing: 5 Predictions for the Future

Are Dealership F&I Managers Going Away?

The role of the F&I department is being transformed. Progressive dealerships have closed the F&I office and replaced it with a single-point-of-contact sales model where the primary responsibility for F&I is with the salesperson. In this system, that salesperson is supported by a sales manager and, in some cases, and F&I administrator.

Other dealerships continue to operate with a traditional F&I office. Progressive dealerships using a traditional model are using enhanced processes and modern software like Fuse Transact to add transparency and speed transactions.

Don’t just take our word for it. Take the word of Sue Wilke, an automotive finance veteran of nearly 30 years who initially opposed the idea of individual dealership employees managing both sales and finance and insurance. But, when customer satisfaction index scores “went through the roof” after the group adopted the model, Wilke, finance director and sales manager of RocketTown Honda, became a believer.

“Consumers dislike being passed from person to person, which occurs under a traditional sales-to-F&I handoff. The hybrid role also allows the customer and salesperson to discuss F&I products at the beginning of the process.”

Sue Wilke, Finance Director & Sales Manager, RocketTown Honda

“To be honest, customers like it better," Wilke admitted. She said consumers dislike being passed from person to person, which occurs under a traditional sales-to-F&I handoff. The hybrid role also allows the customer and salesperson to discuss F&I products at the beginning of the process.

From digital retailing to desking, F&I menus, and more — Fuse offers a comprehensive and customizable solution to support your F&I department and take your dealership to the next level.

Related Read: How Walser Toyota Landed the #1 Spot for Passenger Car Sales in 2022 Using Automated Financing

The Future of Automotive Retail

Get in touch now to discover how Fuse can help transform your dealership's F&I process.

The Future of Automotive Retail

Get in touch now to discover how Fuse can help transform your dealership's F&I process.